| Founded | Government of India |

| Headquarters | New Delhi |

| Products | Taxation |

| Services | Goods and Services Tax |

| People | Arun Jaitley (Finance Minister) |

| Ownedby | Department of Revenue |

| Website | gst.gov.in |

| facebook.com/pg/gstsystemsindia | |

| twitter.com/gstindia | |

| Logo |  |

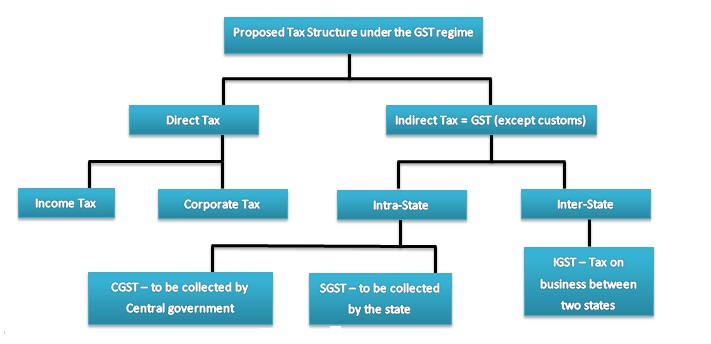

"GST" means Goods and Services Tax, GST (Hindi: जीएसटी) is a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India. It is proposed system of indirect taxation in India merging most of the existing taxes into single system of taxation.

Proposed GST India Taxation System:

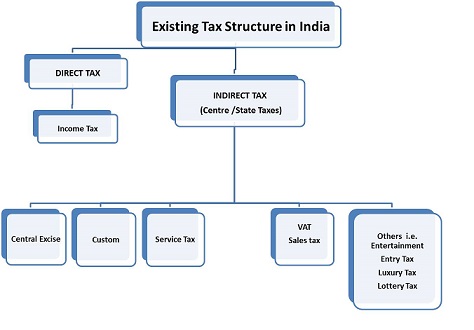

Existing Tax Structure:

Benefits of GST - For business and industry :

System: A comprehensive System to make compliance easy and transparent.

Tax Rates : Uniformity of tax rates and structures across all states with one Goods and Services Tax.

Hidden Costs: Transparent layer removing the hidden costs

Uniform Costs: This will ease the product costs for the long term, so industries can plan well in advance a uniform cost for all states.

GST Bill: The Goods and Services Tax bill, to be Indias biggest tax reform since independence, Bill will help to simplify the current system of taxation. The GST bill will convert the country current structure into a unified market by replacing all the indirect taxes with one tax irrespective of different state tax laws or at taxes at many levels. Here is the GST video example shown in case of manufacturing to retailer:

Latest GST News: Uncertainty clears for India, GST deadlock ends: All set for 1 July roll out. GST Service Tax: Luxury, standard, basic tax slabs to replace current rate on services, The goods and services tax (GST) Council is planning to bring different tax structure for services, The highest rate would be for luxury services, instead of a uniform rate of tax on all services, including cess and surcharge, the tax structure would possibly be on three rates: Luxury, Standard and Basic. It will be the first time since service tax was introduced in July 1994 that there would be more than one rate for the tax.

Existing State Tax Registered users can register GST website gst.gov.in

Existing GST users can be logged into the site with username and password. Click to GST login

Problem for Register or Update Digital Signature Certificate for GST? Failed to establish connection to the server, Kindly restart the Emsigner Click here to troubleshoot.